pa local tax filing deadline 2021

2021 Extension Request and Payment Voucher. Officially the deadline for filing local taxes remains April 15.

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

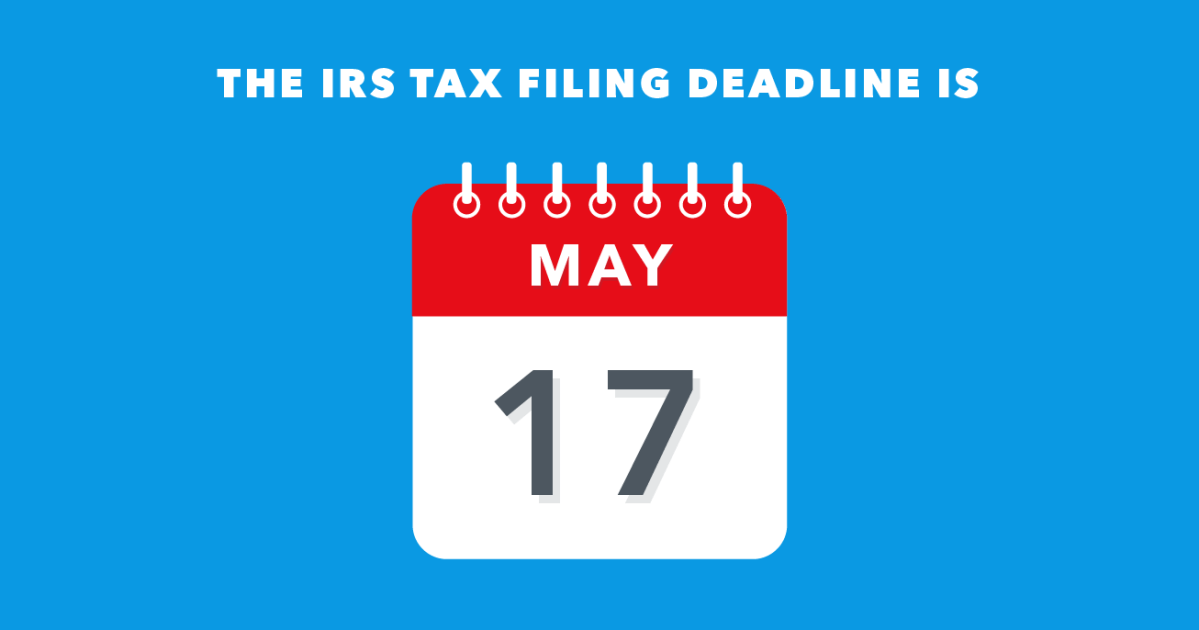

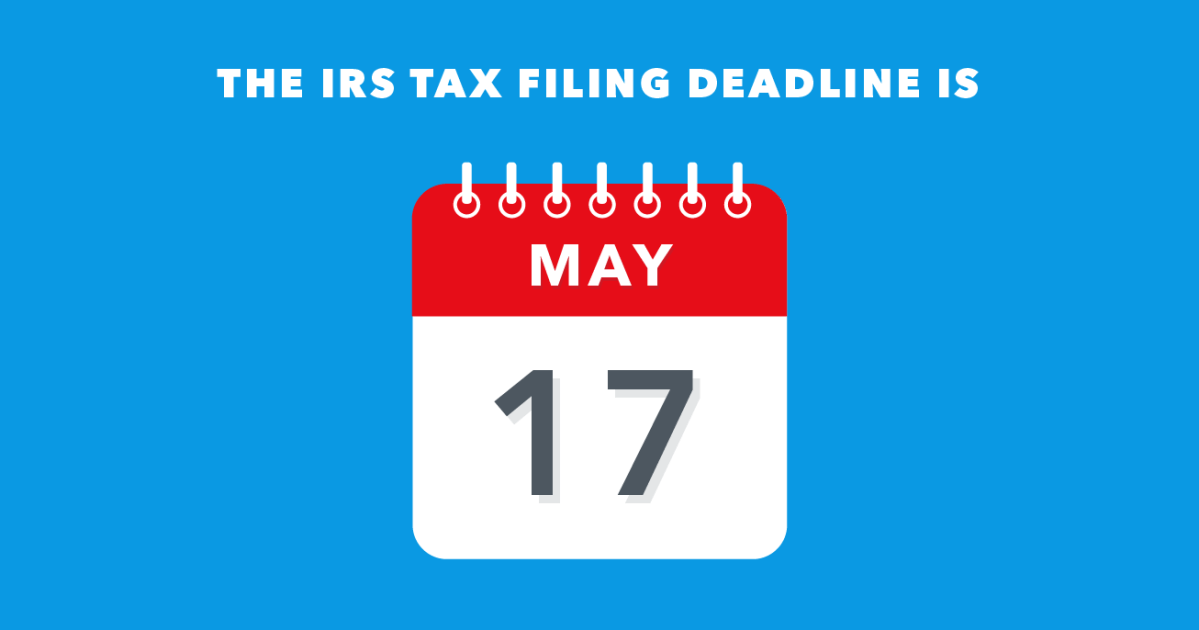

The PA Department of Revenue and the IRS announced that the income tax filing deadline for the final annual return 2020 is extended to May 17 2021.

. The 2021 local earned income tax filing due date is April 18th 2022. The Franklin County Area Tax Bureau FCATB generally follows the decisions of the Pennsylvania Department of Revenue PA DoR regarding the personal income tax filing deadline. Contact us to quickly and efficiently resolve your tax needs.

Despite federal and state deadline extensions local tax returns are still due April 15. File Your Local Earned Income Tax Return Online March 16 2022 Pennsylvania residents with earned income or net profits must file a local earned. The Centre Tax Agency CTA also known as the State College Borough was established as a result of Act 32 of 2008 in order to provide tax collection services for municipalities and school districts within the Centre County Tax Collection District TCD.

Pennsylvania Department of Revenue Online Services File Your Taxes. While the PA Department of Revenue and the IRS announced. 2021 Personal Income Tax Forms.

To remain consistent with the federal tax due date the due date for filing 2021 Pennsylvania tax returns will be on or before midnight Monday April 18 2022. But fess wont be imposed for another month. The federal and state government approved a delay for.

TAX FORGIVENESS Depending on your income and family size you may qualify for a refund or reduction of your Pennsylvania income tax liability with the states Tax Forgiveness program. Wheres My Income Tax Refund. The PA Department of Revenue and the IRS announced that the income tax filing deadline for the final annual return 2020 is extended to May 17 2021.

Click the link at the top of the page to go to the online filing system. March 18 2022 Harrisburg PA With the deadline to file 2021 Pennsylvania personal income tax returns a month away the Department of Revenue is extending its cus. Their contact information is.

A taxpayer must report all taxable income received or accrued during the calendar year from Jan. Keystone Collections said today The Local Earned Income Tax filing deadline has NOT been extended beyond the April 15 2021 due date. Local governments may wish to consult with their solicitors on whether and how they might explore alternatives to waive interest andor penalties for local tax filings and payments that are made on or before May 17 2021 which is the extension for filing federal and state taxes.

The department will be able to process 2021 personal income tax estimated payments made in 2021 if taxpayers complete and mail a PA-40ES I Declaration of Estimated Tax coupon to the department along with their check for the estimated tax amount. Revenue Department Extends Call Center Hours to Assist Late-Season Tax Filers. 1419 3rd Avenue PO Box 307 Duncansville PA 16635-0307.

Pennsylvania Extends Personal Income Tax Filing Deadline to May 17 2021. Opens In A New Window. The 2021 Earned Income Tax annual return deadline is April 18 2022.

Online filing continues to be available. We specialize in all Pennsylvania Act 32 and Act 50 tax administration services. 11 rows BLAIR TAX COLLECTION DISTRICT.

Blair County Tax Collection Bureau. Harrisburg PA The Department of Revenue today announced the deadline for taxpayers to file their 2020 Pennsylvania personal income tax returns and make final 2020 income tax payments is extended to May 17 2021. April 14 2021.

Property TaxRent Rebate Status. To request an extension of time to file a local earned income tax return and pay tax due online Go to. The Berks Earned Income Tax Bureaus due date for the 2021 local individual income tax return is also changed to April 18 2022.

This means taxpayers will have an additional month to file from. While the usual tax return filing deadline is April 15 the deadline to file the 2021 Personal Income Tax Return is April 18 2022 per the PA-40IN 2021 Pennsylvania. BRADFORD TAX COLLECTION DISTRICT.

Forms may be obtained via the Taxpayer Forms and Info link at the top of. Time for 2021 Filing Time for 2021 Filing Time for 2021 Filing. The Pennsylvania Department of Revenue follows the Internal Revenue Service IRS due date for filing returns.

The local earned income tax filing deadline is accordingly extended to match the State and Federal date of May 17 2021. The local earned income tax filing deadline. The Bureau also collects Local Services Tax.

Jordan Tax Service is responsible for the collection of Real Estate Tax in Peters Township. 2021Extension Request and Payment Voucher. Submit Extension Request and Payment Due on or Before April 18.

That is Keystone will not apply late-filing penalty and interest on tax year. We are the trusted partner for 32 TCDs and provide services to help Individuals Employers Payroll Companies Tax Preparers and Governments. We are Pennsylvanias most trusted tax administrator.

Williamsport PA 17701. Taxpayers should write 2021 Estimated Tax Payment and the last four digits of the primary. Employers with worksites located in Pennsylvania are required to withhold and remit the local.

When to File Deadline to File Return. The York Adams Tax Bureau collects and distributes earned income tax for 124 municipalities and school districts in York and Adams Counties. All residents of Adams County and all residents of York County except West Shore School District file their annual earned income tax returns with YATB.

Do You Need To File A Tax Return In 2022 Forbes Advisor

Tax Day 2022 Freebies Discounts And Deals

Why Some Americans Should Still Wait To File Their 2020 Taxes

5 Tips For Filing Your Taxes By The Oct 15 Deadline Forbes Advisor

Where S My Pennsylvania State Tax Refund Taxact Blog

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

How Do State And Local Individual Income Taxes Work Tax Policy Center

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Tax Rate H R Block

The Irs Is Behind In Processing Nearly 7 Million Tax Returns An Early Warning Sign The Agency Is Under Strain The Washington Post

Prepare And Efile Your 2021 2022 Pennsylvania Tax Return

Pennsylvania Department Of Revenue Parevenue Twitter

Pennsylvania Property Tax H R Block

Federal Income Tax Deadline In 2022 Smartasset

Pennsylvania Sales Tax Small Business Guide Truic

:max_bytes(150000):strip_icc()/Clipboard01-ff7baf48e79f47d79d4510e9e9bf728f.jpg)